A Guide to Renting Apartments Without a Deposit: Key Insights to Consider

Finding an apartment to rent with no deposit required is becoming more relevant as people look for flexible and affordable housing options. This guide outlines how some renters navigate no-deposit agreements, what property owners typically offer in these cases, and the types of lease terms that may apply. Understanding how these arrangements work helps individuals assess long-term affordability, compare different housing setups, and explore factors like location, access to transit, and included amenities. More insights on what others consider when renting without upfront costs are available throughout.

What Are No Deposit Apartments and How Do They Work?

No deposit apartments are rental properties where landlords waive the traditional security deposit requirement or accept alternative arrangements. Instead of collecting a lump sum upfront, property owners may opt for monthly rental insurance premiums, rent guarantee services, or other financial protections. These arrangements benefit renters who lack substantial savings while still providing landlords with security against potential damages or unpaid rent. The process typically involves credit checks, income verification, and sometimes co-signer requirements to ensure tenant reliability.

Understanding Rent Guarantee Scheme Options

A rent guarantee scheme provides landlords with financial protection while eliminating the need for tenants to pay large deposits. These programs typically involve third-party companies that guarantee rent payments to landlords if tenants default. Renters usually pay a monthly fee, often ranging from 5-15% of their monthly rent, in exchange for this service. Some schemes also cover property damage up to certain limits. Government-backed programs in various countries offer similar protections, particularly for low-income renters or first-time tenants who may not qualify for traditional rental agreements.

Exploring Rental Insurance Options for Tenants

Rental insurance options serve as alternatives to traditional security deposits by providing coverage for both tenants and landlords. These policies typically cost between $10-50 monthly and cover property damage, unpaid rent, and sometimes personal liability. Some insurance products specifically replace security deposits, allowing tenants to pay small monthly premiums instead of large upfront costs. Many landlords accept these policies because they often provide better protection than traditional deposits, which may not cover extensive damages or multiple months of unpaid rent.

Accessing Low Income Housing Aid Programs

Low income housing aid encompasses various government and non-profit programs designed to help qualifying individuals secure affordable housing without substantial upfront costs. Housing choice vouchers, commonly known as Section 8, can significantly reduce rental costs and often eliminate deposit requirements. Local housing authorities frequently maintain lists of participating landlords who accept vouchers and may waive deposits. Additionally, many communities offer emergency rental assistance, first-time renter programs, and deposit assistance funds specifically designed to help low-income individuals access stable housing.

Real-World Cost Comparisons and Provider Options

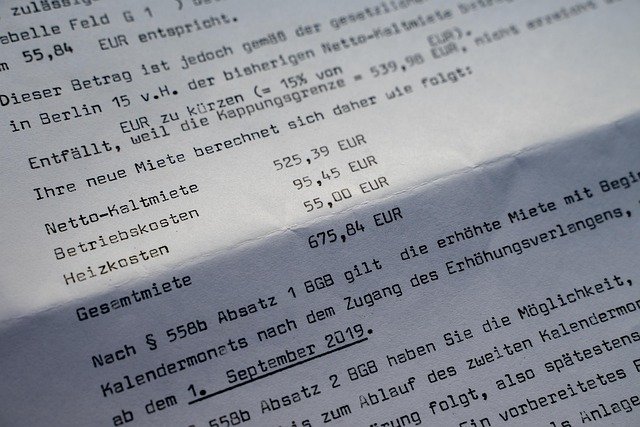

Understanding the financial implications of different no-deposit solutions helps in making informed decisions. Traditional security deposits typically range from $500-3000 depending on location and rent amount, while alternative options offer more manageable monthly payments.

| Service Type | Provider Example | Monthly Cost Range | Coverage Details |

|---|---|---|---|

| Rental Insurance | Rhino | $15-100/month | Deposit replacement, damage coverage |

| Rent Guarantee | TheGuarantors | 5-15% of monthly rent | Rent guarantee, damage protection |

| Deposit Alternative | LeaseLock | $25-200/month | Full deposit replacement service |

| Government Aid | Local Housing Authority | Varies by income | Vouchers, direct assistance |

Prices, rates, or cost estimates mentioned in this article are based on the latest available information but may change over time. Independent research is advised before making financial decisions.

Tips for Successfully Securing No Deposit Rentals

Successfully securing no deposit apartments requires preparation and understanding of what landlords seek in tenants. Maintaining good credit scores, providing employment verification, and offering references significantly improve approval chances. Some landlords may require higher monthly rent or additional insurance coverage in lieu of deposits. Building relationships with local property managers and staying informed about new rental programs in your area can reveal opportunities not widely advertised. Consider working with housing counselors or rental assistance programs that can provide guidance and potentially advocate on your behalf with landlords.

Renting apartments without traditional deposits offers valuable flexibility for those facing financial constraints or seeking to preserve cash flow for other expenses. While these alternatives may sometimes result in higher long-term costs through monthly fees, they provide immediate access to housing that might otherwise remain unaffordable. Success in securing no deposit rentals often depends on demonstrating financial responsibility through other means and understanding the various programs and services available in your local market. By exploring rent guarantee schemes, rental insurance options, and housing assistance programs, renters can find viable paths to secure quality housing without the barrier of large upfront deposits.